UAE Market Trends 2025-2026

U.S. Vertical AI Shift

Unlocking the $90 Billion Prize. A 2026 Playbook for Founders & Investors

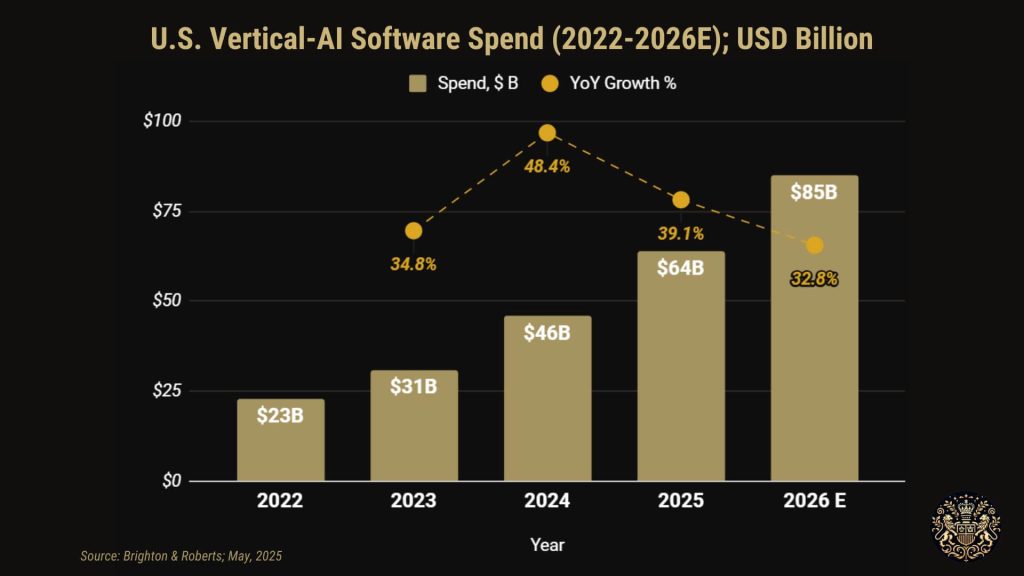

General-purpose LLMs have reached feature parity in many B2B tasks, flattening price points for horizontal providers. The premium, however, has shifted to Vertical-AI products that embed proprietary industry data, handle compliance, and deliver workflow-level ROI. U.S. spend on vertical AI software is set to reach $78-92 billion by 2026 (35-40 % CAGR, Brighton & Roberts Analytics), with regulated sectors capturing two-thirds of new ARR.

For founders, this is a blueprint for defensible niches and faster payback cycles.

For investors, it is a roadmap to 8-10 × ARR exit multiples as incumbents race to acquire domain depth.

The Macro Tailwinds

| DATA | INVESTOR INSIGHT | FOUNDER INSIGHT |

|---|---|---|

| Funding flow: U.S. vertical-AI startups raised $4.6 billion in 2024, up 64 % YoY; deals over $50 million clustered in healthcare imaging, legal doc-review, and industrial anomaly detection. | Capital is rotating out of “chatbot clones.” Late-Series A vertical plays commanding 3-4 × revenue premium to horizontal AI (PitchBook sample of 32 deals). | Growth investors now insist on sector fit metrics (e.g., CPT code coverage, FINRA retention schedules) before term sheets—build these artifacts early. |

| Adoption delta – Firms that deployed domain-trained models cut task times 45-60 % vs. generic LLMs (Brighton & Roberts benchmark across 18 pilots). | Workflow penetration, not model novelty, drives valuation; diligence should include time-saved per user and audit-trail depth, not parameter counts. | Show clear before-after KPI uplifts (e.g., reduce legal review hours from 7.2 to 3.6) to shorten enterprise procurement cycles to <120 days. |

U.S. Vertical AI Software Spend Data for 2025-2026

Anatomy of a Winning Vertical-AI Stack

| LAYER | KEY METRICS & BENCHMARKS | INVESTOR & FOUNDER TAKEAWAYS |

|---|---|---|

| Data Moat | Minimum viable corpus: 10-15 million labeled domain records or >3 years of longitudinal sensor / transaction data. |

Investors – insist on contractual exclusivity or synthetic-data rights; avoid ventures that merely fine-tune on public sets. Founders – land first-party data partners early and lock multiyear rights to prevent copycats. |

| Workflow Glue | Average B2B user toggles between 7.4 tools per task; vertical-AI that embeds inside core systems (EHR, PLM, DMS) sees 2× daily active use. |

Investors – value integrations (HL7, SAP BAPI, Relativity API) as leading indicator of stickiness. Founders – allocate ≥20 % of engineering to native connectors, not just model R&D. |

| Compliance Wrapper | Annualized penalty risk: up to $50 000 per HIPAA breach incident; $10 000 per SEC document error. |

Investors – price in regulatory leverage: software that removes recurring audit cost captures budget that is rarely cut. Founders – bundle audit-ready logs, role-based access, and explainability dashboards; these raise win-rates by 15-20 % in RFPs. |

Sector Scorecard (2025-2026)

| Vertical | Market Size/Spend (2026E) | Efficiency Delta vs. Legacy | Key Risk | Investor Angle | Founder Angle |

|---|---|---|---|---|---|

| Healthcare – Diagnostic Imaging & Rev-Cycle | $24 billion software TAM | 30-50 % faster reads; 1.6 pp EBITDA lift for rev-cycle firms | FDA algorithm drift audits every 12 months | Consolidators (Philips, GEHC) need bolt-ons that cut payor denials; 8-10 × ARR M&A precedents | Secure longitudinal PACS feeds; pursue 510(k) pathway early to keep sales cycle under 18 months |

| Legal Tech – Contract & E-Discovery AI | $9.8 billion | 40-60 % review-time cut; paralegal cost down $95 hr → $38 hr equiv. | Hallucinated clauses trigger liability | Private-equity roll-ups target 25 % IRR on doc-automation suites | Align output to SOC 2 + ISO 27001; offer indemnity add-on (<2 % ARR) to ease GC concerns |

| Manufacturing – Quality & Predictive Maintenance | $13-15 billion | Scrap/warranty costs -12-18 % per plant | OT-network data sparsity | High ROI yields quick paybacks (<12 months) – ideal for revenue-backed debt | Package as “Analytics-as-a-Service” billed per line-hour; qualify for federal smart-manufacturing tax credits |

All figures are provided exclusively by Brighton & Roberts Analytics unless otherwise cited.

Action Checklists

For Founders:

- Data Rights First – Negotiate exclusive or multi-year semi-exclusive access; cap rev-share at <10 % to protect margins.

- Integrate, Don’t Replace – Ship pre-built connectors to the top two systems of record in your vertical; charge extra only for complex on-prem installs.

- Compliance ROI Pitch – Quantify audit-hour savings and potential fine avoidance; CFOs sign faster than CIOs when hard dollars appear.

- Board Metrics – Track Model Uptime, Audit Pass Rate, Time-to-Value (goal: <30 days). Investors anchor term-sheet premiums on these.

For Investors:

Moat Diligence – Ask for raw schema samples and data-license agreements; no “public-only” plays.

Workflow Penetration – Interview at least three end-users on daily click-path reduction; ignore vanity AI benchmarks.

Regulatory Hedge – Favour startups whose product removes compliance cost (HIPAA, FINRA, FAA) rather than depends on lenient rules.

Exit Map – Identify 3-4 likely acquirers per vertical; track their cash & goodwill lines—most will reload AI war-chests in 2025-H2.

Bottom Line

Vertical-AI is no longer a side-bet, but it is where real budget and scarce data converge.

Founders who capture exclusive data + workflow seat-time + compliance relief create businesses that resist commoditisation.

Investors who underwrite those three levers, and pass on “model-only” hype, will own the compounding cash flows of the next software cycle.

Relevant data links:

- U.S. Food and Drug Administration (FDA) – AI/ML-Based Software as a Medical Device (SaMD): Regulatory updates, approvals, and pilot programs for AI in diagnostics.

- Assistant Secretary for Technology Policy .ONC Interoperability & Health IT Certification: For EHR integrations, FHIR standards, and data-sharing mandates relevant to vertical AI

- Administrative Office of the U.S. Courts – Federal Rules of Civil Procedure: Sets discovery standards that e-discovery tools must meet.

- U.S. Department of Justice – AI Use in Legal Processes: Occasionally publishes updates on AI risks, legal usage, and policy guidance.

- U.S. SEC – Cybersecurity & AI Disclosure Guidelines. Relevant for AI used in financial risk modeling and disclosure-compliance tools.

Disclaimer: The information provided is for informational purposes only and does not constitute financial, investment, or other professional advice. Readers should consult with a qualified professional before making any investment decisions. The authors and publishers are not liable for any losses or damages arising from the use of this information.